We have just released our second Financing and Real Estate Update (FREU) for 2021. The updates are published twice a year in collaboration with mortgage and real estate market experts MoneyPark.

FREU 2/2021: Prices continue to rise across Switzerland

Key findings at a glance:

- Prices for houses rose by 1.9% in the first half of 2021

- The average yield for flats across Swiss municipalities is 2.96%

- 10-year mortgage deals account for 55% of the total mortgage market

- 27% of mortgages are lent by pension funds

- Customers were able to save up to 0.41% a year on the standard rate

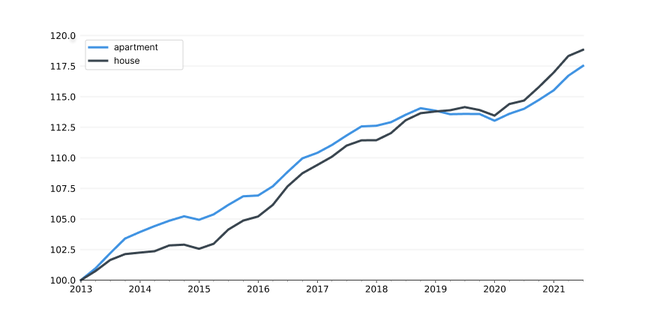

Real estate price index

(Figures correct as of 30 June 2021/100 = 2013/Basis for comparison: 31 December 2020)

Purchase prices for houses and flats in Switzerland have continued to rise since 31 December 2020. Prices for flats are rising slightly faster than those for family homes. Purchase prices for owner-occupied flats have risen by two percentage points, while prices for family homes are up 1.9%.

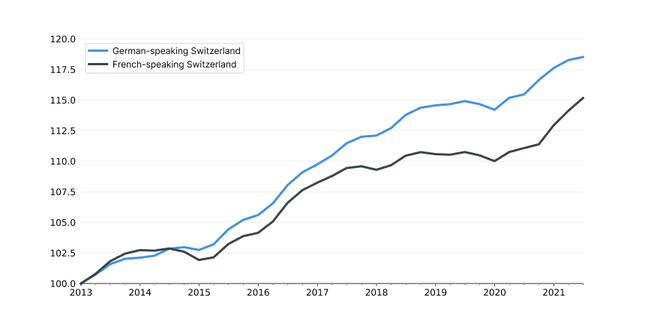

Prices for family homes in French-speaking Switzerland have risen sharply, by 2.2% over the last six months. By way of comparison, prices in German-speaking areas have risen 0.9% over the same period.

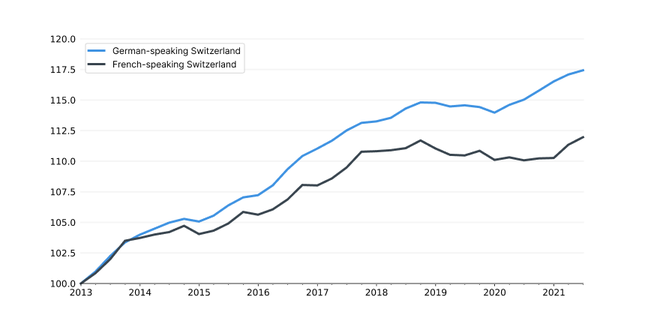

Since 31 December 2020, prices for flats in French-speaking Switzerland have risen by 1.7%, while the average price of a flat in German-speaking Switzerland has risen at a more gradual 0.9%. .

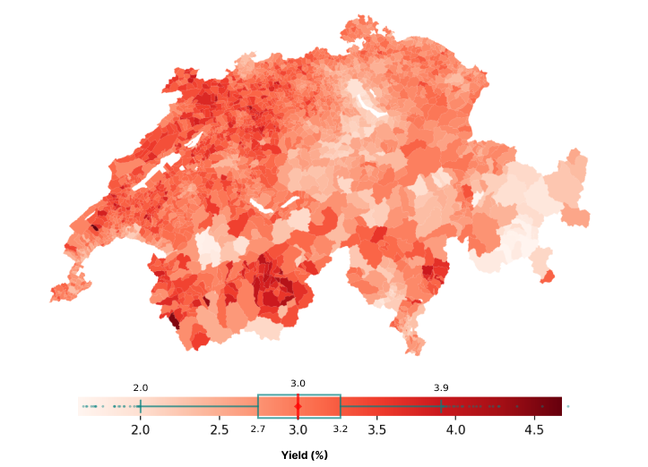

Yields and mortgage lengths in Swiss municipalities

Average yields in the Swiss municipalities for flats vary between 1.96% and 3.88% (99% and 1% quantile), equating to mortgage terms of between 26 and 51 years. The highest yield can be found in Berolle, at 4.67%. The lowest is 1.60%, in Sils im Engadin/Segl.

The average yield across all municipalities is currently 2.96%, meaning it is almost unchanged from the last study (it was 3.00% in the second half of 2020). As far as yields in individual cantons are concerned, the lowest rates are still in Zug, Basel-Stadt and Obwalden, at less than 2.45%. On the other hand, Switzerland’s highest yields are to be found in Jura, Neuchâtel and Solothurn, with all three delivering rates in excess of 3.20%.

Download the full study (in German)

We can produce regional rates of return analysis for you. Get in touch with us at media@pricehubble.com.

See also

Introducing the new and improved Property Pages - the best way to impress Buyers and Sellers

We are excited to introduce the new version of Property Pages in Property Advisor—a game-changer for real estate professionals looking to captivate and build trust with home buyers and sellers. With a modernized design, enhanced insights, and optimised calls to action, these Property Pages help you showcase properties more effectively and deliver a seamless experience, to help you convert prospects faster. Plus, with 2 versions, one optimised for buyers and one for sellers.

4 ways your risk management API integration platform simplifies informed decision-making

Effective risk management is essential for staying competitive in today's fast-paced real estate landscape. As risks from regulatory shifts, market volatility, and environmental factors grow more complex, organisations are turning to advanced solutions to make informed decisions. A risk management platform that leverages API integration capabilities acts as a connector between disparate data sources and automates workflows, enabling businesses to streamline processes.

Top 10 digital banking platforms for success in 2025 and beyond

With more and more Europeans embracing the convenience of online banking, digital banking platforms have become a cornerstone of modern financial services. In 2023, 70% of EU citizens used online banking services, according to a Eurostat report. Mobile apps and online platforms have transformed how banking customers engage with their finances, providing greater control, convenience, and personalisation.