We are pleased to provide you with the Financing and Real Estate Update (FREU) from Mortgage specialists MoneyPark and the Proptech company PriceHubble.

The most important findings in brief:

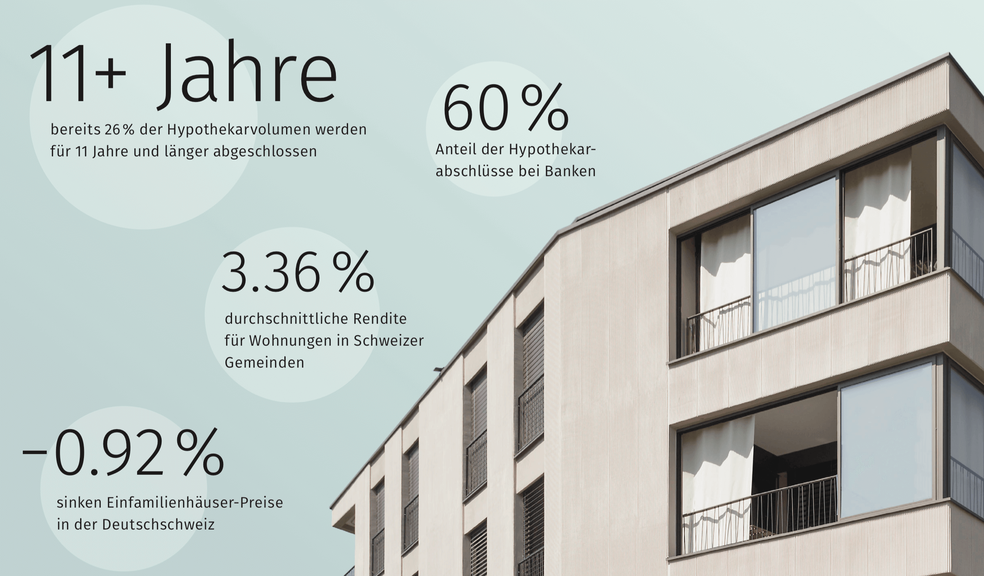

- Prices for single-family homes fell in the 2nd half of 2019 in German-speaking Switzerland by 0.92%.

- The average yield for apartments in Swiss municipalities is 3.36%

- Already 26% of the mortgage volume is concluded for 11 years and longer

- The proportion of mortgages taken out with banks is now only 60%

- Up to 0.33% per year could be achieved compared to the standard saving rate

The Financing and Real Estate Update (FIMU) will in future be published every six months. The cross-market analysis provides a practical overview of developments in the mortgage and real estate markets and combines the findings from both worlds.

The data-driven PriceHubble model index shows market-oriented price developments in the past half year for single-family homes and apartments, subdivided throughout Switzerland and into German and French-speaking Switzerland. In addition a yield map for Switzerland included.

MoneyPark determines the most popular mortgage products every six months and analyses the volume shares of the three provider groups bank, insurance and pension fund - each divided into German and French-speaking Switzerland. The comparison of the last six months effectively concluded mortgage interest with the window display interest rates of the providers also shows the possible savings potential per supplier group.

Should you have any questions or require further analysis of the Swiss real estate market, please do not hesitate to contact us!