Welcome to the digital future: this is how insurance and financial service providers can use the topic of real estate valuation to increase sales results in their core business

Real estate is one of the largest and most important investments for many end clients. Yet its role in financial and insurance consulting is underestimated too often. Cross- and upselling potentials remain untapped, or the need for a product and advice is handled by another provider such as a specialised real estate consultant.

In fact, the subject of real estate is an important starting point for a range of services that stretch from advisers for insurance, assets and finance to wealth managers or family offices. Used in the right way, real estate offers a path to enormous sales potential by letting you reach customers at an earlier stage, convert them better and ensure greater loyalty to you. These 4 strategies help advisers turn the topic of real estate into a real catalyst for client relationships, without having to slide into the role of an amateur real estate agent.

1) Strengthening the client relationship and establishing an emotional connection

Products in finance and insurance are often purely abstract for customers. The connection to the topic is substantially more rational than emotional. “Products in finance and insurance are fairly uncool from the perspective of consumers”, says Patrick Sindermann, PriceHubble Key Account Manager, who has spent 13 years in the area of financial and insurance sales, and understands the problem.

However, the relationship to real estate is very different. Everyone needs a roof over their head, and most people are ready to invest a lot of time, love and energy to secure and shape their home. This can also be incorporated into the advisory process, if done right. “The topic of housing usually makes people quite animated. They open up, and it is a perfect way in, which is pleasant for both sides,” Patrick Sindermann explains on the basis of his own experience.

Each customer has a practical and emotional connection to real estate in one form or another, either as a tenant, as ahomeowner or owner-occupant and sometimes also as an investor. Therefore, real estate is ideally suited as an anchor for products in finance and insurance that are otherwise fairly emotionless. If real estate is actively considered in the investment and risk strategy, not only customer loyalty, but also the quality and individuality of the consultation will increase.

2) Meeting and exceeding customer expectations

In a very competitive sector such as the finance and insurance industry, it is becoming increasingly difficult to set yourself apart from competitors. Naturally, there has been a rise in customer expectations as a result of this. Expectations include, but are not limited to:

– transparency,

– reliability,

– 24/7 digital information availability,

– an optimal price-performance ratio and

– results of the consultation that can be quantified by return on investment.

Having an information edge on the client’s real estate situation can only be an advantage in all these cases. Such an edge is exactly what PriceHubble’s easy and effective products offer. They make it possible to meet the demand for advice that would otherwise go to a competitor, such as a real estate agent.

Including real estate in your advisory services is not only an additional service, but also an investment, primarily in client loyalty. “You can also demonstrate flexibility to the younger generation of clients,” explains Raja Beurer, Senior Key Account Manager at PriceHubble. Fulfilling or even exceeding clients’ expectations lets you make them feel like they are in the best hands and fully supported, which increases the potential that you will be recommended to others.

3) Supporting clients during changes

Clients don’t just need financial and insurance advice for the traditional purchase of real estate. Financial and insurance consultants can also support their clients and help them avoid typical pitfalls, for example before the purchase of real estate, before renovation, in cases of inheritance, for project developments and for investments in or the disposal of real estate as a capital investment. In this case, residential real estate has a critical advantage over commercial real estate.

Whereas commercial real estate requires a case-by-case analysis with careful consideration given to the use and tenant constellation, the valuation of residential real estate is connected to the property itself and can therefore be automated to a high degree.

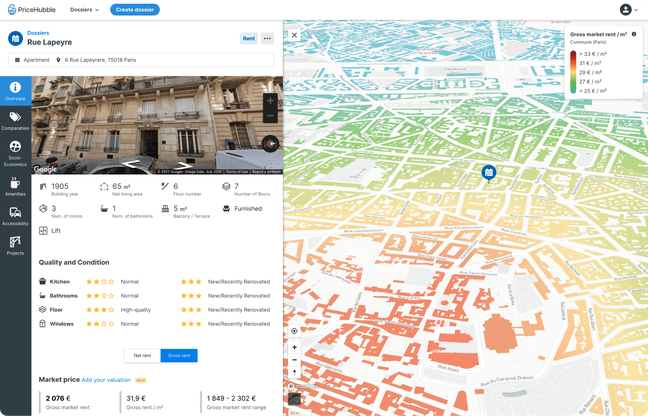

In order to make such a valuation as easy and accessible as possible, PriceHubble’s digital tools use relevant sources for the collection of millions of current data points specific to the location and property, and analyse this information anonymously by using an AI algorithm.

The results of this analysis can be viewed in the PriceHubble platform through an intuitively operated dashboard. This visualises real estate values individually and by street and can effectively map a wide range of aspects in the location analysis – everything from the rental and market price to the public transport connection. For the end customer, this valuable objective information can be compiled in a handy exposé and shared digitally via a permalink.

“Most clients, for example in cases of inheritance, have no idea what their real estate is actually worth on the market at the moment. If you have the right tool, you, as the adviser, can provide this estimate with just a few clicks,” Raja Beurer explains. And Patrick Sindermann recommends: “Think about it proactively: Where can you advise your customers? Even if real estate is not your core business, you can integrate your services in a supporting manner at each stage – for example, in the form of disability insurance or investment advice.”

Accordingly, for example, financial advisers for clients in a case of inheritance can accurately estimate more than just the current value of a property by using the PriceHubble tools. They can also forecast the added value to be expected by upgrading the property. Furthermore, they can make parallel comparisons such as what realistic returns would look like if the property were sold and the capital were invested in a financial instrument. That is where adviser know-how really bears fruit.

PriceHubble’s diverse tools offer a sound decision-making basis for end clients by compactly and reliably showing objective information. Based on this knowledge, advisers can provide better and more comprehensive help in the event of changes affecting real estate, and thus earn long-term trust.