Between prices at their highest and a record year in terms of transactions, 2019 was a peak year real estate-wise. However, with declining interbank loans, stabilizing mortgage rates, buyers waiting around for their next purchase and property prices that are starting to stabilize, signals pointing towards a slowdown in the number of transactions are starting to be noticeable. This is the finding made by PriceHubble as part of a study carried out in partnership with the new generation agency Proprioo.

2019: the year of all records

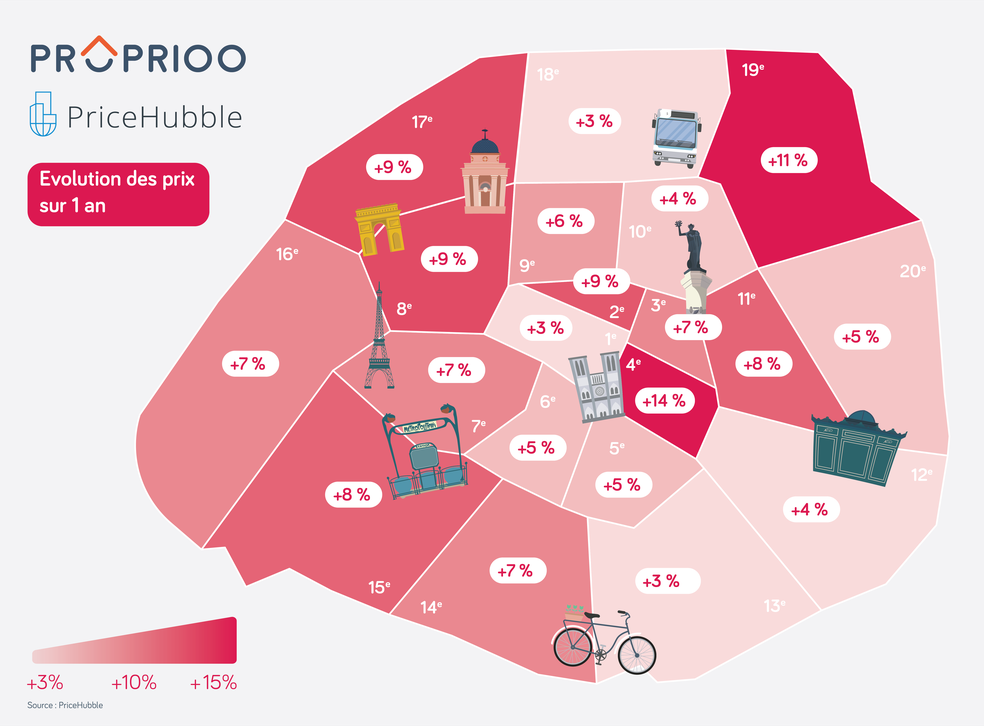

After analyzing all the sales offers published for Paris and the outer suburbs in 2019 on a panel of real estate portals, PriceHubble highlighted the impressive developments over the year. 75,000 offers for sale were therefore analyzed by PriceHubble for the year 2019 and made it possible to highlight the top three Parisian districts which experienced the strongest price increase per m2 in 2019: the 4th (+ 14%), the 19th (+ 11%) and the 2nd arrondissement (+ 9%).

As Loeiz Bourdic, General Manager of PriceHubble France explains, "our statistical analysis of real estate offers month by month in 2019 shows a first slowdown in certain districts in Q4, but a dynamic still bullish in the other districts. It is therefore too early to speak of a reversal which would only be initiated by an increase in rates. We don’t believe in a real estate bubble for Paris, the upward momentum of recent years being driven by a background trend of metropolitanization benefiting urban hearts all over Europe."

After these record increases, the offer data analyzed for Paris in the last quarter of 2019 has however made it possible to highlight a stagnation in prices for certain arrondissements (variations noted in October, November and December 2019), or even a slight decrease in prices.

2020: a turning point in the development of the Ile-de-France property market

In certain arrondissements, prices are stagnating in the last quarter of 2019: the 5th (+ 0.14%), 8th (+ 0.74%) and 16th arrondissement (+ 0.81%) display near-price stability. Others even show a decrease if we compare the median prices per m2 to those of the previous quarter: the 6th (-0.10%), 7th (-1.46%), 10th (-0.76%), 12th (-1.63%) or 20th arrondissement (-1.06%) ended 2019 on a downward dynamic.

Several factors can explain these downward trends.

First, buyers' borrowing capacity can no longer keep pace with rising prices: month after month, records are broken and home mortgage rates have kept pushing the floor. Borrowing rates will therefore begin to stabilize with small rate increases in certain banking institutions.

Second, faced with an increase in the use of credit, banks are becoming more selective about applications they accept. The French government’s announcement about tougher borrowing conditions could help block some households from accessing home ownership.

Finally, with prices reaching record highs, it is difficult for buyers to see their real estate investment amortized. Including notary fees, agency fees and interest rates, the value of their property should increase by at least 10% over the next 5 years to be profitable. Which seems hardly possible to date.

Conclusion

Several scenarios could be envisaged for this beginning of 2020. Experts from the Proprioo agency (who met more than 2,500 buyers in the last quarter of 2019), could observe the emergence of new behaviors during a purchase project:

- Those who move away from Paris

- Those who anticipate a drop in prices and decide to postpone their purchase project

- Those who go into debt beyond the recommended 33% threshold

If you would like to receive a copy of this study, please do not hesitate to contact us.