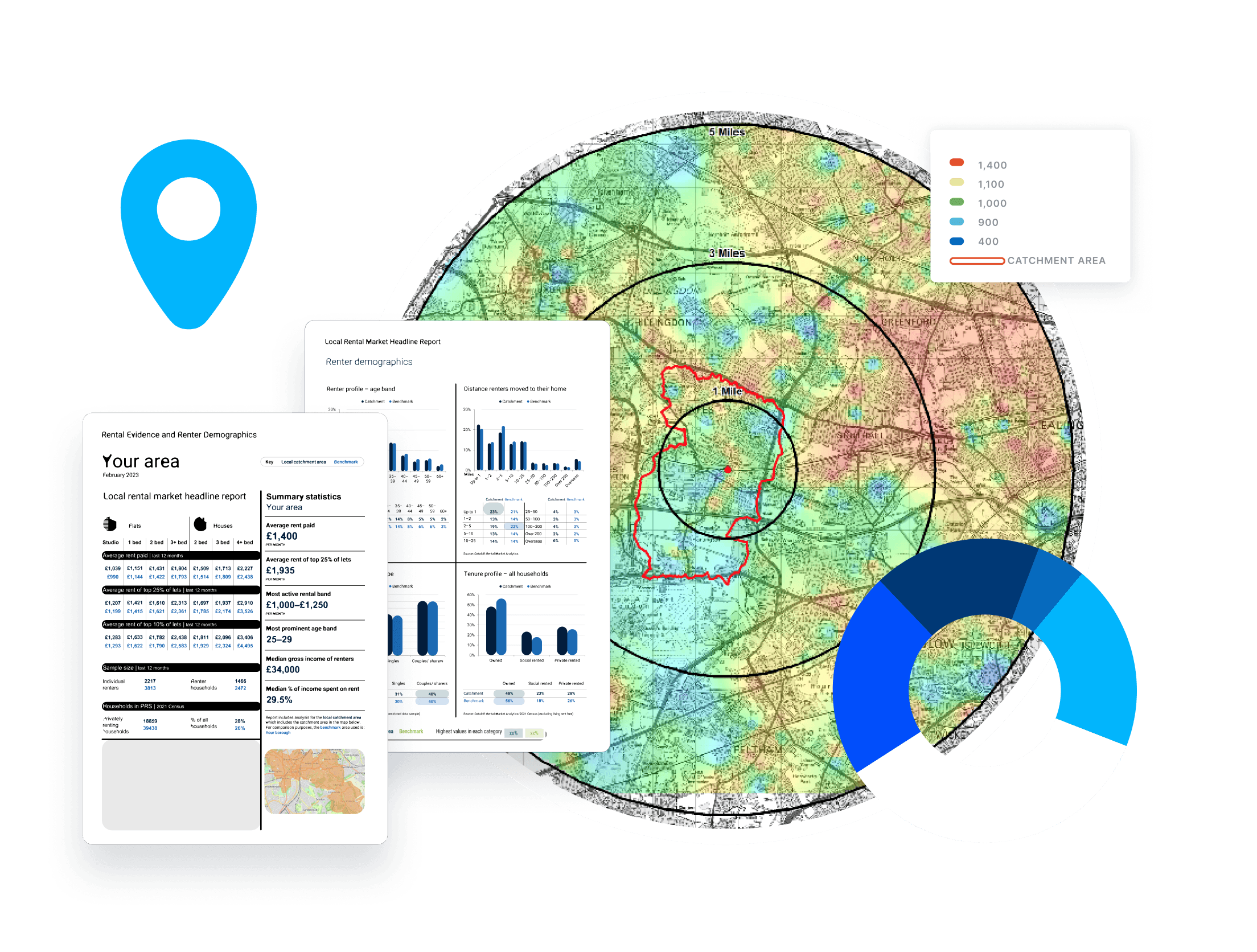

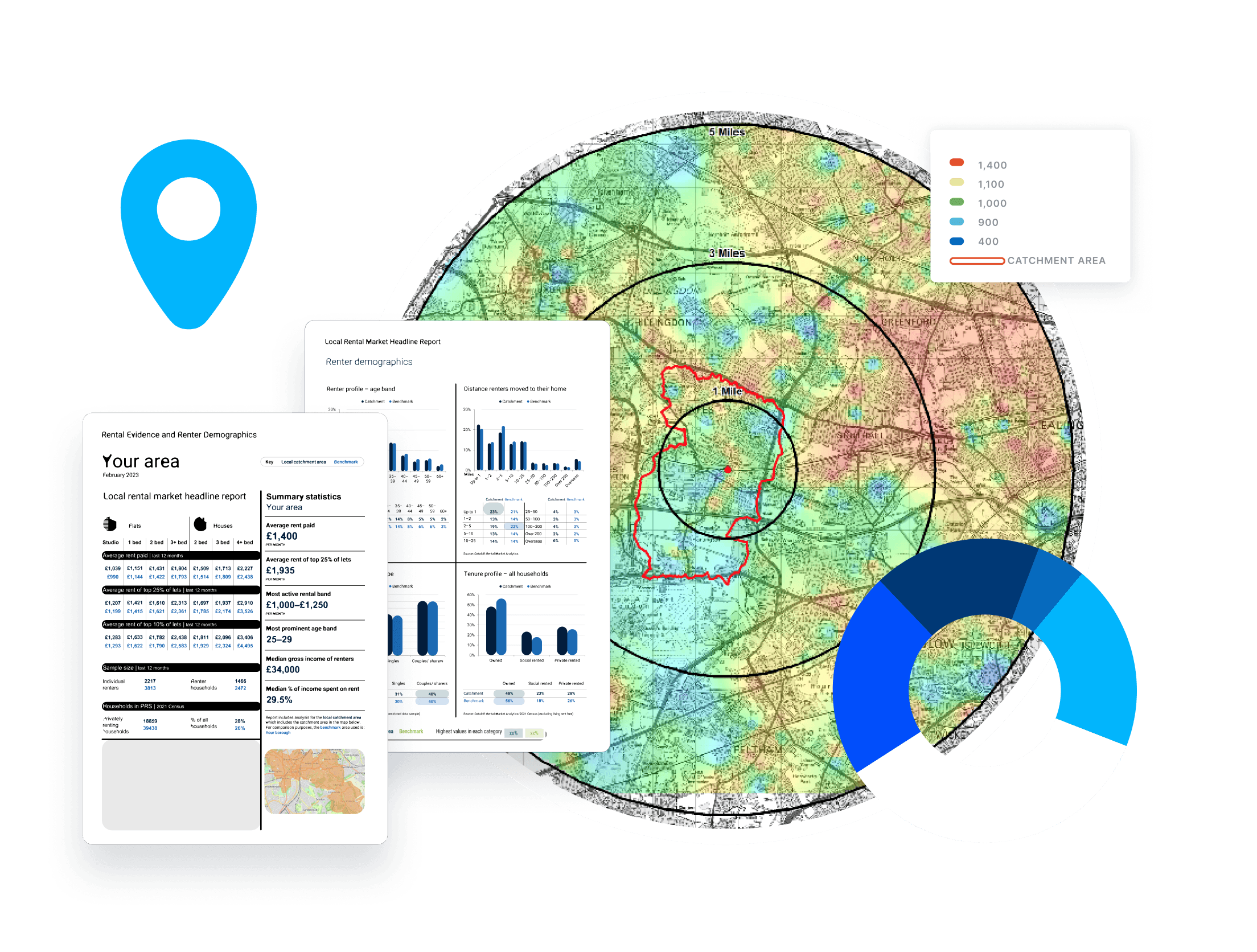

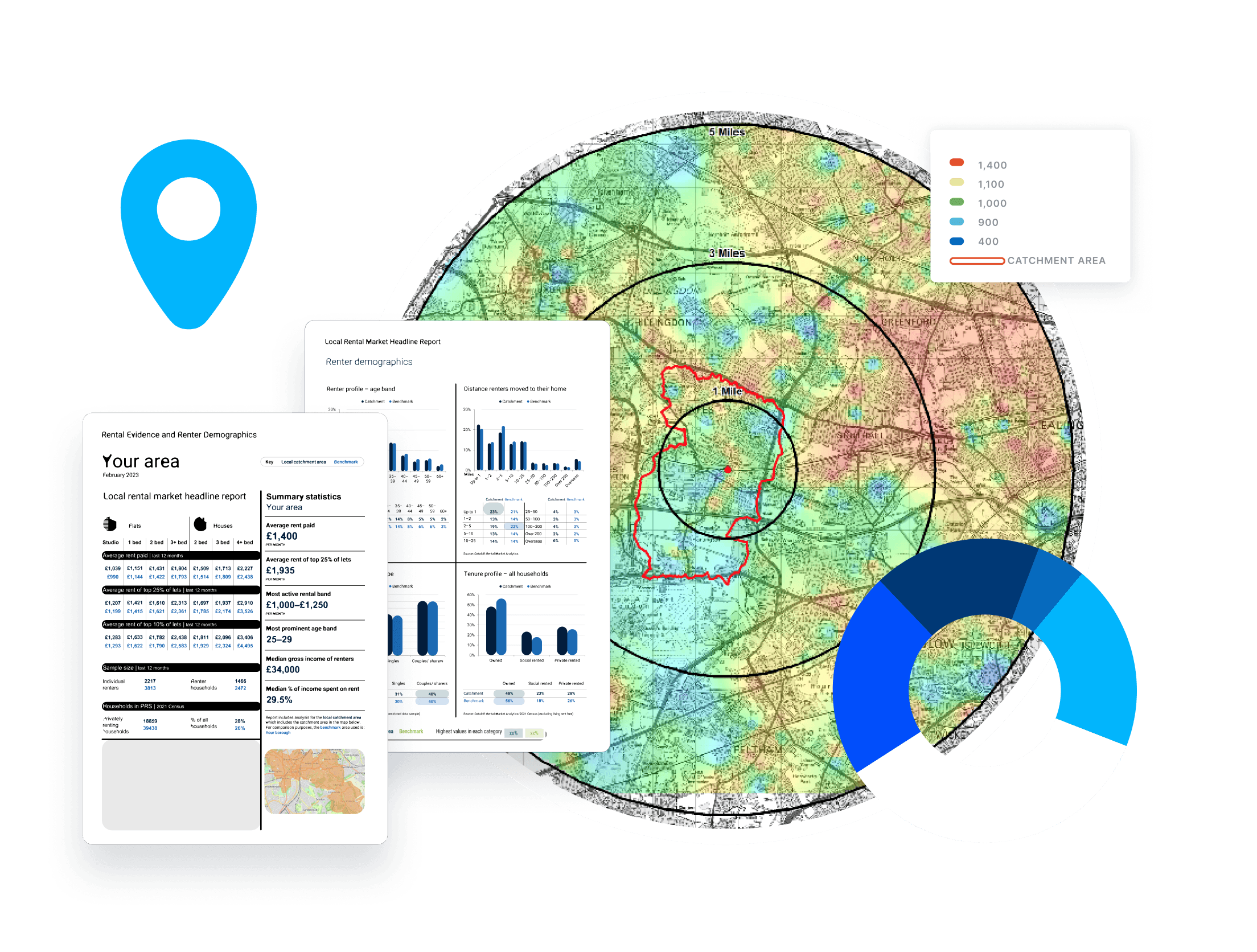

Access instant analytics, market insights & renter demographics

Built for BTR investors, developers and policy-makers, Market Analyser delivers instant access to the UK’s most comprehensive dataset of achieved rents and renter demographics. Explore affordability metrics, sales & rental analytics, local reports and more – all in one easy-to-use platform.

Access instant analytics, market insights & renter demographics

Built for BTR investors, developers and policy-makers, Market Analyser delivers instant access to the UK’s most comprehensive dataset of achieved rents and renter demographics. Explore affordability metrics, sales & rental analytics, local reports and more – all in one easy-to-use platform.

Access instant analytics, market insights & renter demographics

Built for BTR investors, developers and policy-makers, Market Analyser delivers instant access to the UK’s most comprehensive dataset of achieved rents and renter demographics. Explore affordability metrics, sales & rental analytics, local reports and more – all in one easy-to-use platform.

Analytics to support portfolio strategy, identify target locations and underwrite rental values in BTR

Analytics to support portfolio strategy, identify target locations and underwrite rental values in BTR

Analytics to support portfolio strategy, identify target locations and underwrite rental values in BTR

Evaluate opportunities

Quickly assess an opportunity. Instantly view affordability metrics, rents, prices, local amenities and demographics in any UK housing market with interactive charts, tables, maps, reports and infographics.

Evaluate opportunities

Quickly assess an opportunity. Instantly view affordability metrics, rents, prices, local amenities and demographics in any UK housing market with interactive charts, tables, maps, reports and infographics.

Evaluate opportunities

Quickly assess an opportunity. Instantly view affordability metrics, rents, prices, local amenities and demographics in any UK housing market with interactive charts, tables, maps, reports and infographics.

Underwrite rents and rental potential

Metrics and analytics of rental market conditions in any local area. Gather evidence to support rents in unproven locations, based on incomes, affordability, migration and journey time analysis.

Monitor portfolios

Benchmark your portfolios against the wider market to monitor performance against new lettings, based on rental growth, rent percentile, demographic profile and affordability.

Consultancy services

Our team of analysts undertake bespoke commissions for more in-depth studies including Rental Potential and Market Profiles. Our City Model is designed to guide portfolio strategy by ranking locations according to their potential for rental performance. It is based on around 40 housing, economic and demographic data variables.

Underwrite rents and rental potential

Metrics and analytics of rental market conditions in any local area. Gather evidence to support rents in unproven locations, based on incomes, affordability, migration and journey time analysis.

Monitor portfolios

Benchmark your portfolios against the wider market to monitor performance against new lettings, based on rental growth, rent percentile, demographic profile and affordability.

Consultancy services

Our team of analysts undertake bespoke commissions for more in-depth studies including Rental Potential and Market Profiles. Our City Model is designed to guide portfolio strategy by ranking locations according to their potential for rental performance. It is based on around 40 housing, economic and demographic data variables.

Underwrite rents and rental potential

Metrics and analytics of rental market conditions in any local area. Gather evidence to support rents in unproven locations, based on incomes, affordability, migration and journey time analysis.

Monitor portfolios

Benchmark your portfolios against the wider market to monitor performance against new lettings, based on rental growth, rent percentile, demographic profile and affordability.

Consultancy services

Our team of analysts undertake bespoke commissions for more in-depth studies including Rental Potential and Market Profiles. Our City Model is designed to guide portfolio strategy by ranking locations according to their potential for rental performance. It is based on around 40 housing, economic and demographic data variables.

The Rental Market Analytics dataset —10 years of transaction history

7.8 million lines of data

50,000 new lines of data per month

Achieved rents and asking rents

Around 50% of all achieved rents and full coverage of asking rents

Age, income, affordability, employment

Demographics at renter and household level

The Rental Market Analytics dataset —10 years of transaction history

7.8 million lines of data

50,000 new lines of data per month

Achieved rents and asking rents

Around 50% of all achieved rents and full coverage of asking rents

Age, income, affordability, employment

Demographics at renter and household level

The Rental Market Analytics dataset —10 years of transaction history

7.8 million lines of data

50,000 new lines of data per month

Achieved rents and asking rents

Around 50% of all achieved rents and full coverage of asking rents

Age, income, affordability, employment

Demographics at renter and household level

Insightful content and news articles powered by Market Analyser

Insightful content and news articles powered by Market Analyser

Insightful content and news articles powered by Market Analyser

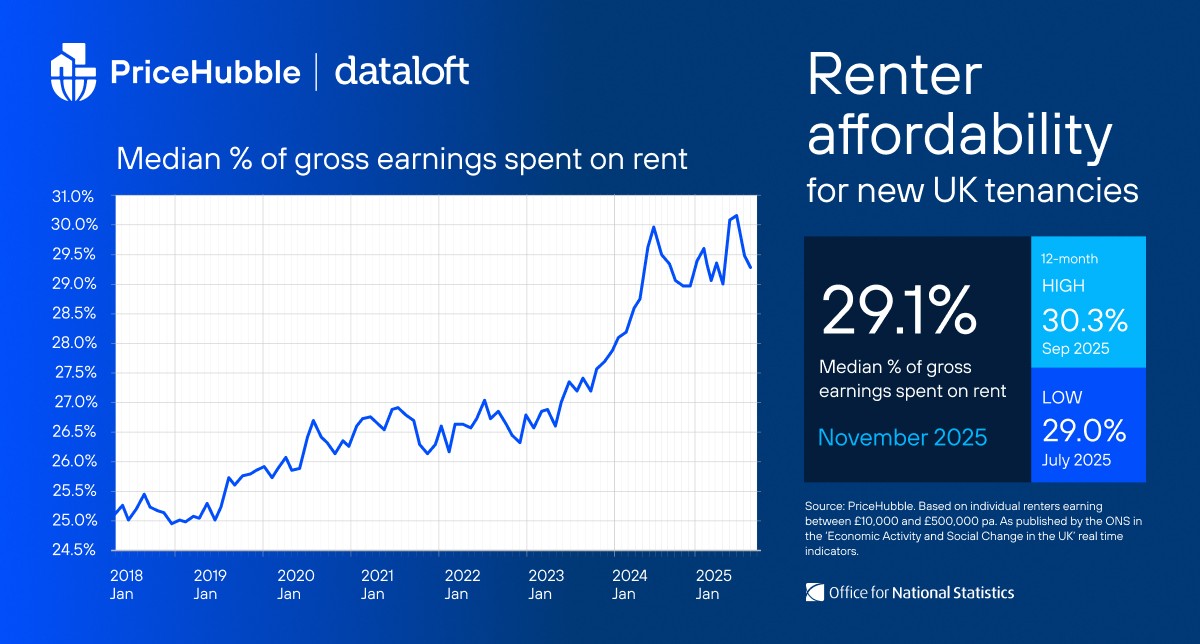

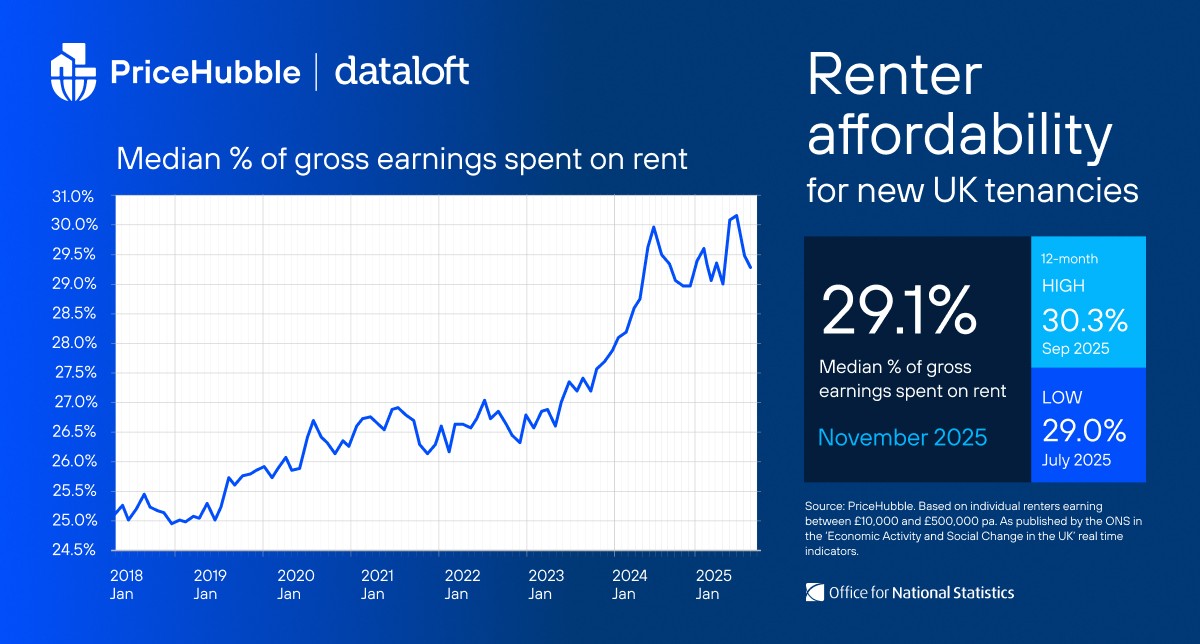

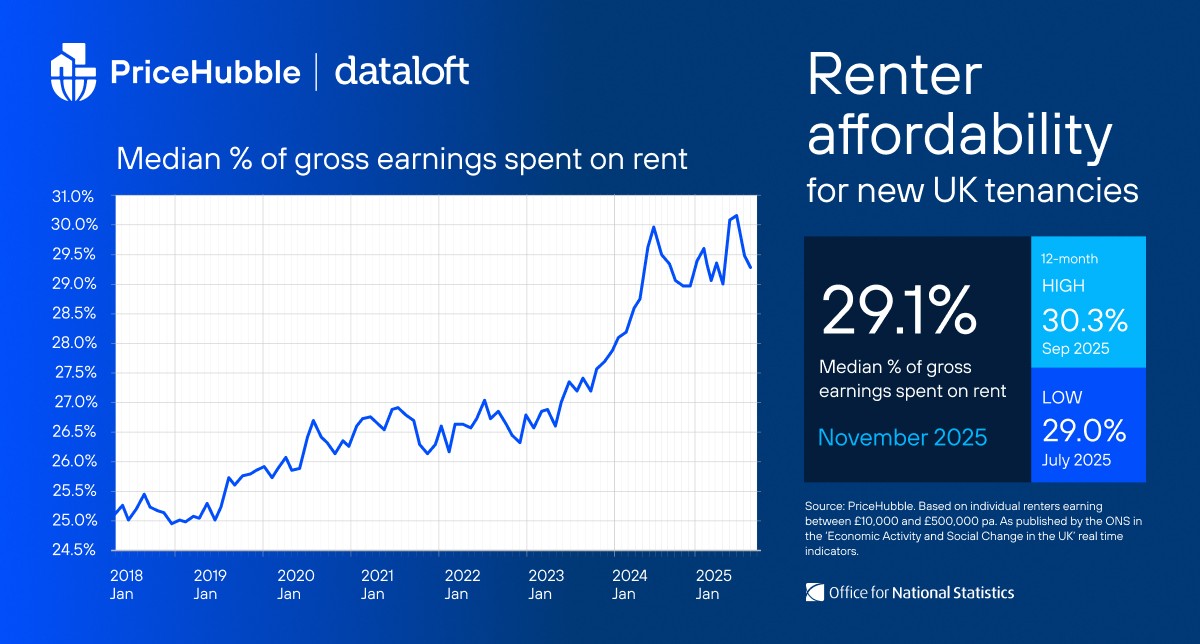

Affordability tracker

Our monthly UK Affordability Tracker, published by the Office for National Statistics and regularly featured in the FT and BBC monitors trends in average affordability.

7 perspectives on rental affordability

Market Analyser users can analyse affordability for any local market in the UK. To put it to the test, we've explored how Affordability Ratios vary with income, location and time.

In the press | BBC - Families forced into smaller homes

In collaboration with the BBC's data journalist team, we provided an analysis of the rental market for families. It showed how the average size of a home has shrunk over the past three years as rents have risen. Accurate data, thoughtful insight, and balanced reporting are critical when the pressing need for more homes in the UK is under such scrutiny.

The UK rental market in 10 charts

Our latest analysis paints a detailed picture of the private rental market in the UK. The findings provide a comprehensive overview of the sector, highlighting who rents, what type of properties they are renting, how much they pay, and much more.

Affordability tracker

Our monthly UK Affordability Tracker, published by the Office for National Statistics and regularly featured in the FT and BBC monitors trends in average affordability.

7 perspectives on rental affordability

Market Analyser users can analyse affordability for any local market in the UK. To put it to the test, we've explored how Affordability Ratios vary with income, location and time.

In the press | BBC - Families forced into smaller homes

In collaboration with the BBC's data journalist team, we provided an analysis of the rental market for families. It showed how the average size of a home has shrunk over the past three years as rents have risen. Accurate data, thoughtful insight, and balanced reporting are critical when the pressing need for more homes in the UK is under such scrutiny.

The UK rental market in 10 charts

Our latest analysis paints a detailed picture of the private rental market in the UK. The findings provide a comprehensive overview of the sector, highlighting who rents, what type of properties they are renting, how much they pay, and much more.

Affordability tracker

Our monthly UK Affordability Tracker, published by the Office for National Statistics and regularly featured in the FT and BBC monitors trends in average affordability.

7 perspectives on rental affordability

Market Analyser users can analyse affordability for any local market in the UK. To put it to the test, we've explored how Affordability Ratios vary with income, location and time.

In the press | BBC - Families forced into smaller homes

In collaboration with the BBC's data journalist team, we provided an analysis of the rental market for families. It showed how the average size of a home has shrunk over the past three years as rents have risen. Accurate data, thoughtful insight, and balanced reporting are critical when the pressing need for more homes in the UK is under such scrutiny.

The UK rental market in 10 charts

Our latest analysis paints a detailed picture of the private rental market in the UK. The findings provide a comprehensive overview of the sector, highlighting who rents, what type of properties they are renting, how much they pay, and much more.

Find out more about Market Analyser

Whether you’d like a quick chat, a discovery call or just have a query, we’re here to help. Get in touch using this form.

Find out more about Market Analyser

Whether you’d like a quick chat, a discovery call or just have a query, we’re here to help. Get in touch using this form.

Find out more about Market Analyser

Whether you’d like a quick chat, a discovery call or just have a query, we’re here to help. Get in touch using this form.

Request a demo

We will get back to you quickly.

We look forward to speaking with you.

Thank you!

We will get back to you within 24 business hours.